Bitcoin came within 1% of $100,000 on Nov. 22 with bulls “chewing away” at final sell orders.

Bitcoin eats up last supply below $100,000

Data from Cointelegraph Markets Pro and TradingView confirmed the latest new Bitcoin BTCUSD price all-time highs near $99,500 on Bitstamp.

After a brief dip below $96,000, BTCUSD rebounded into the Asia trading session to set up what could be a showdown with six figures.

Commenting on the action, trader Skew predicted that a “violent breakout” may result once the price clears ask liquidity near the key $100,000 mark.

“Still seeing limit bids moving higher with underlying spot buyers ~ Positive market signal,” part of an X post read.

“A lot of aggregate spot supply around $100K. Price currently is chewing away at this supply, before this has preceded a pretty violent breakout.”

An accompanying chart showed ladders of asks clustered in the upper $99,000 area on the Binance order book.

Earlier, Skew eyed asks appearing above $100,000 as a suggestion that the market was pricing in further “parabolic” upside once it is reached.

Keith Alan, co-founder of trading resource Material Indicators, noted that some traders were tempted to short BTC at current levels.

“Shorts are getting lured in,” he reported, echoing Skew on the likely consequences.

“If you are taking the bait, be prepared to get squeezed.”

The day prior, data from monitoring resource CoinGlass confirmed, short BTC liquidations reached just shy of $115 million.

Binance avoids “FOMO” volume spike

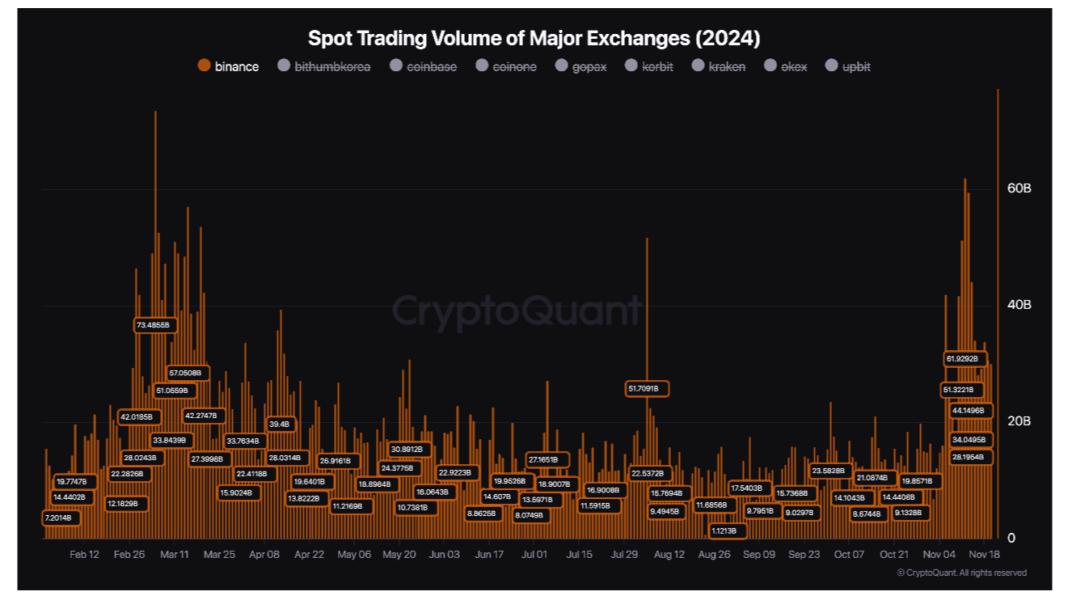

Observing exchange activity, meanwhile, onchain analytics platform CryptoQuant noted a curious trend.

After spiking as the overall crypto market cap beat its old all-time highs earlier this month, Binance’s aggregate trading volume has declined.

“The recent surge in spot trading volume (60B) on Binance occurred on November 12, coinciding with the crypto market cap nearing its previous ATH.

“However, trading volume has since decreased by half meanwhile the total crypto market cap enters price discovery mode,” contributor Darkfost wrote in a Quicktake blog post.

“This decline in spot trading activity may suggest that the market is taking a breather, with investors exercising caution.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.