Bitcoin Open Interest (OI) surged to a new all-time high as Bitcoin rallied to $75,000, and several analysts suggest there could be more upside ahead.

Bitcoin BTCUSD OI — a metric tracking the total number of unsettled Bitcoin derivative contracts such as options and futures — reached $45.41 billion, representing a 13.29% increase since Nov. 5, when Bitcoin’s price broke through its $73,800 all-time high set in March, according to CoinGlass data.

OI increases when the number of new long positions opened by buyers or new short positions by sellers is more significant than the number of contracts closed on that day.

Traders don’t appear to expect Bitcoin’s price to retrace to the previous high of $73,679 anytime soon, with $1.26 billion in short positions at risk of liquidation if it does.

At the time of publication, Bitcoin is trading at $75,792, according to TradingView data, and analysts are speculating that the price is in an ideal range.

“Bitcoin is now in the sweet spot of the bull market halving cycle that should top in the $130k to $150K range next Aug/Sep. I measure cycles differently than most,” veteran trader Peter Brandt wrote in a Nov. 6 X post.

Analysts suggest Bitcoin has more room to grow

While Bitcoin’s new all-time highs often raise concerns among newer crypto investors about the asset being overvalued, not all analysts agree.

Crypto analyst Rajat Soni, for one, believes it’s still early:

“We are so early in Bitcoin’s adoption that you can still exchange pieces of paper ($, €, £, etc.) for BTC because most of the world thinks fiat currencies are backed by something tangible.”

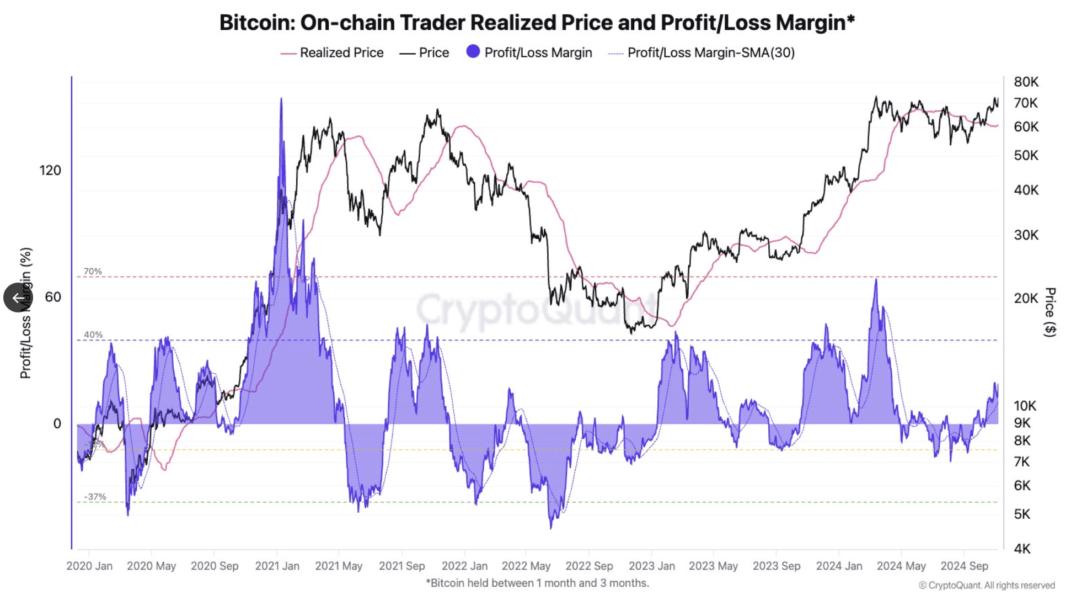

Echoing a similar sentiment, crypto analysis firm CryptoQuant stated that Bitcoin is “not overheated” yet.

“Bitcoin’s new all-time high doesn’t mean it’s overvalued relative to its cost basis,” the firm stated in a Nov. 6 X post.

The analysis firm explained that Bitcoin’s Market Value to Realized Value (MVRV) ratio “is still far from peak levels.”

The higher the MVRV, the more it signals to traders that Bitcoin may be overbought. When Bitcoin reached its all-time high of $73,679 in March, the MVRV was around 2.87, according to Bitbo data.

At the time of publication, Bitcoin’s MVRV score is 2.19.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.